Companies of all sizes should have return-to-work (RTW) programs in place. When an injured employee makes a seamless transition back to full duty, everybody wins.

Ideally, RTW programs (sometimes called modified duty, light-duty, and transitional duty) are launched with extensive training in how to avoid injury in the first place. The best time to implement a program is before someone strains a back, takes a hard fall, or inhales toxic fumes.

Still, it’s never too late to put safety first.

The Goal OF RTW PROGRAMS

Workers who were hurt or made ill on the job need time to get up to speed. Good programs help employees ease back into full productivity without reinjury.

During recovery, light-duty jobs are modified to accommodate physical limitations.

It’s true that RTW programs require planning, collaboration, and training. They take time to develop. But, their success is a product of trial and error.

However, companies that design effective programs are never sorry that they did. Boosting productivity, morale and the bottom line always pays off.

Benefits for Employers

The biggest perk for employers is a reduction in Workers’ Compensation costs. According to the Bureau of Labor Statistics, payments to injured or sickened workers approached a whopping $40 billion in 2015.

Injured employees who return to work even part-time collect fewer benefits.

Also, Workers’ Compensation premiums are often the largest expense after payroll. Keeping accidents and injuries to a minimum keeps premiums in line.

Effective RTW programs also limit fraudulent and abusive claims. If your boss were genuinely interested in your recovery and accommodated you with light-duty, wouldn’t you be less inclined to scam him?

Along the same lines, private investigation is rarely called for when employees get back to work quickly.

Even a little productivity is better than none, and retaining good workers saves a fortune in hiring and training costs.

For all these reasons, RTW programs make good business sense.

Benefits for Employees

Continuing to earn income — even if wages are temporarily reduced for light-duty — keeps food on the table. There are also physical and psychological benefits.

Private investigation usually exposes injured workers who attempt to cheat the system, but it sometimes reveals just how isolating and depressing a serious injury can be.

Experts agree that returning to work, even on a limited basis, speeds recovery. Purpose, socialization, and a sense of one’s own value have a positive impact on health.

Making RTW Programs Effective

The hardest part is getting started, but employers who drag their feet could soon find themselves out of business.

It’s a collective effort. If you’re in safety, risk management, Workers’ Compensation or law, business owners and executives could use your help.

Here are some factors that distinguish truly effective programs:

Safety is ingrained in the workplace culture

What does that look like?

The best programs are a valued part of the company culture just like teamwork or work-life balance.

Time and financial resources are invested in safety. Training is thorough and unrushed. Safety is the first item on the agenda of every meeting.

Safety is a condition of employment, and there are consequences for violating rules. Workers are comfortable pointing out unsafe conditions or behavior.

Licenses and certifications are current. There are high standards for documenting injuries.

Not surprisingly, injury rates are low or nonexistent.

Everyone is on board

Management is 100% committed, and workers at all levels know that their superiors embrace safety as a core value.

It takes a natural leader with an engaging personality to make that happen.

Hazards are identified and addressed

New companies identify jobs, equipment, or workspaces with high potential for injury. Older companies review their history to pinpoint the most common injuries and find out how they occurred.

The RTW team brainstorms about ways to protect workers in those positions. Certain jobs may be modified. Safer equipment might be installed. Training may be reevaluated.

This is a great time to ask at-risk employees for suggestions.

Thorough job descriptions are published

Existing job descriptions include duties, physical requirements, and functional requirements such as standing or heavy lifting.

Planners have even thought of ways to convert existing jobs to transitional duty.

For instance, a kitchen steward with a back injury shouldn’t lift 50-pound bags of rice, but there are plenty of onions to chop and potatoes to peel. There may even be bigger fish to fry.

Jobs have also been cobbled together for alternate duty. Ideas include oiling machinery, taking inventory, labeling shelves, answering phones, ordering supplies, making copies, and monitoring security video.

These transitional jobs may be rough sketches, so to speak, but they’re down on paper as possibilities anyway. That shows employees that management will do its best to accommodate them.

RTW-minded managers also consider injured workers for vacant positions.

There’s a designated liaison

A compassionate, organized person who likes working with people acts as a liaison between injured workers, managers, and doctors. Someone who hopes to partner with a doctor is ideal. Third-party administrators (TPAs) can be that solution – there to keep in close contact with all parties and keep the program moving forward.

RTW policies are published and distributed

Company policy clearly defines expectations for both managers and workers. Everyone has a copy.

Workers know how and when to notify the company of injury. Contact numbers are provided.

Employees are familiar with the Family and Medical Leave Act (FMLA) and the Americans with Disabilities Act (ADA). Where workers’ compensation is concerned, they understand both their rights and their accountability.

Effective RTW programs are fair to everyone.

Evaluation metrics are in place

RTW coordinators track results – bigwigs in corner offices dig that stuff.

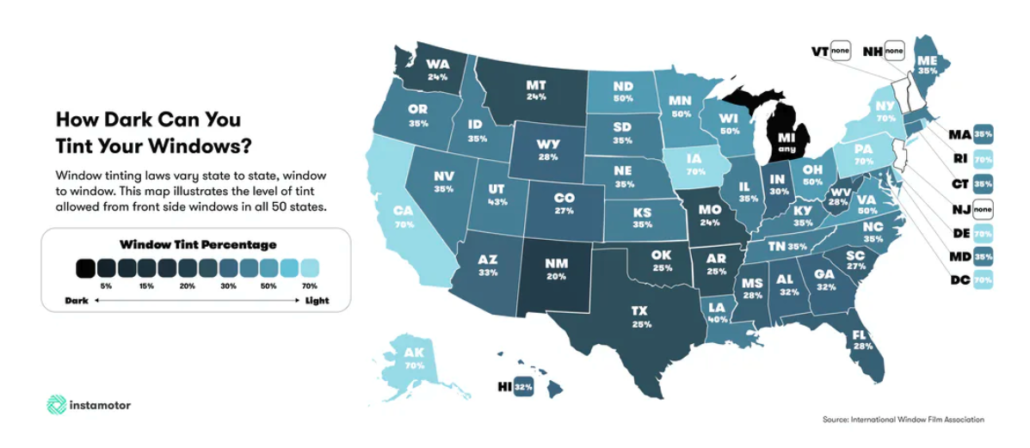

Executives or small-business owners comply with municipal, state and federal laws

Compliance is a lot more complicated than most suits or entrepreneurs know. The importance of working with an attorney can’t be overstated.

The High Cost of Complacency

The cost of keeping workers safe and active is a drop in the bucket compared to the cost of settlements, high turnover rates and lost productivity.

Employers simply can’t afford to be complacent.